Our solar panels were installed by Bold Alternatives (now Better Together Solar, or BT) in early 2012 and went live in July of that year. Under that partnership, BT paid all the costs of construction and collected the federal tax credits that would not have been useful to us since we are tax-exempt. The arrangement called for First U to pay BT for the electricity the panels generated, at a slight discount from CEI rates. Thus, First U did not initially benefit much financially at the start. However, the contract indicated that once BT had recovered their costs, ownership of the panels would be turned over to us at no charge.

UUCC received ownership of the panels at the end of 2021. So how do things work now? Let’s look at 2023.

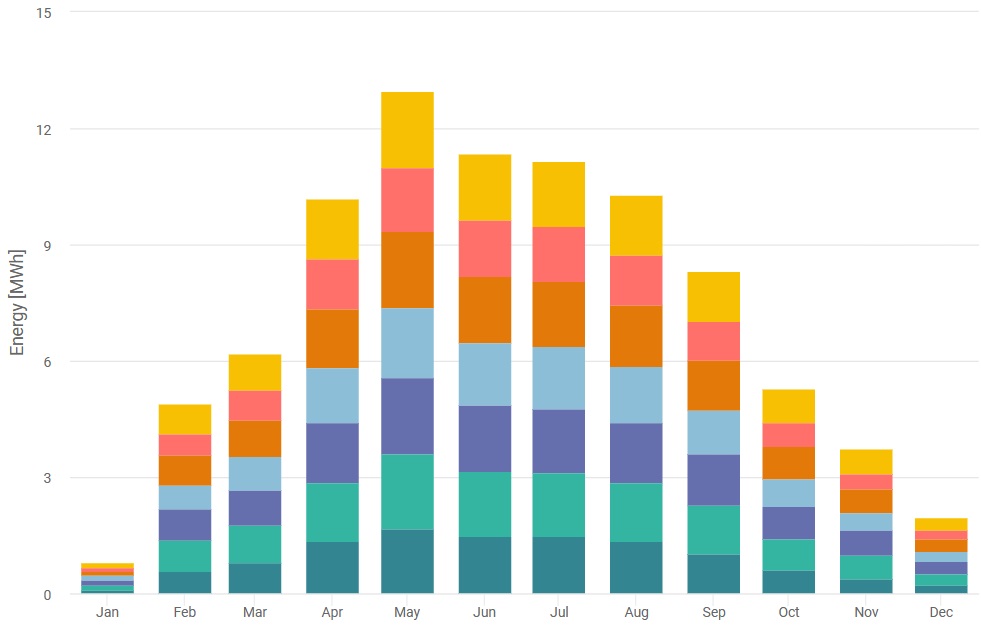

During the year, UUCC used a total of 85,066 kwh of electricity. The panels meanwhile generated 87,170 kwh (see the chart for monthly statistics). Does that mean our electricity bill was zero? Not even close. First off, as with residential electric bills, there are two components, distribution and generation. When you “shop” for electricity, it’s only for the generation portion. The distribution portion is always CEI, and we need to pay that on top of the cost of the electricity itself. In addition, we have “net metering” billing by month, and for 6 of the 12 months we used more electricity than the panels generated, so we had to buy power. During the 6 months we generated more than we needed we sold power back to the grid, but at a lower rate than when we buy.

Over the course of the year, our electric bills added up to $4425. That’s a savings of about $10,000 vs not having the panels. In addition, now that we own the panels we are eligible to sell carbon offset credits. BT recently sold some credits on our behalf for $3900.

If you have any questions, please Don Stimpert, the Finance Committee Chair.

Share this post: